5C Capital Markets Update

2022 is off to a volatile start. Globally, equities are down approximately 7% (1); the technology & growth ladened NASDAQ is down almost 9% (2); the Crypto currency market is under pressure with Bitcoin declining by 17% and the 10 year treasury bond yield has gone from 1.5% to 1.8%.

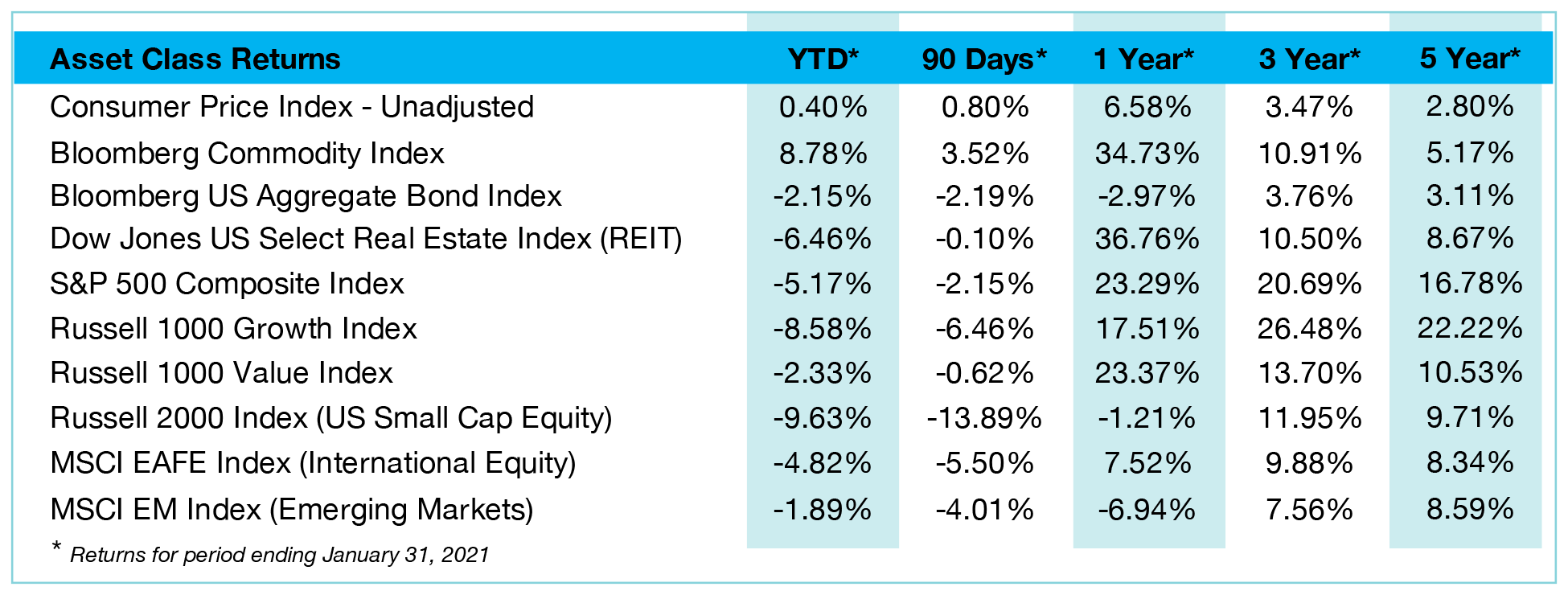

The table below summarizes various asset class returns through the last five years; the strongest being growth equities. Near term, commodities and emerging markets have outperformed and provided unexpected but much needed support.

High profile economic risk factors dominate the news: waning consumer confidence, inflation/interest rates, waiting for COVID-19’s next variant and its overall persistency, geopolitical unrest (Russia/Ukraine, North Korea and China) and where to find our next pile of freely available rare earths and lithium.

For 2022, we project volatile global markets and muted total returns compared to 2020-21 as the macro-economic environment shifts along with prevailing outlooks on the pandemic, monetary policy and fiscal stimulus.

We expect inflation to remain high for the next few months, but moderate significantly during the latter part of 2022; longer-term inflation expectations remain closer to average. Despite early year weakness, we believe that the prospect for a full recession remains low. Our overall outlook for the economy is positive.

Staying diversified and invested will be key to long term success. Severe volatility makes market timing even more difficult. We prefer strategic asset allocation and rebalancing – note the March 2020 “COVID-19” selloff and 20/21 V-shaped market recovery.

Economic Transition and Bumpy Market

2020’s pandemic-induced recession albeit short lived was moderated by strong fiscal and monetary policy responses. During 2021, domestic markets broadly appreciated approximately 20%, led by energy, real estate and financial sectors.

For 2022, we anticipate that COVID-19 related disruptions will become less frequent and the economy will continue to expand. Economic transition is a normal part of a maturing economic cycle, and should continue, with real GDP growth and job creation down a notch from 2021 peak levels. Despite moderating growth, 2022 consensus expectations call for a still-robust 3.9% increase in real GDP – which compares favorably to any single year in the decade following the Global Financial Crisis. For 2023, the economy is expected to move towards its pre-pandemic trend, with GDP slowing to 2.5% growth and job creation similarly moderating. This normalization is a positive development; interestingly the slack created by the recession is being absorbed much faster than usual. The time required for earnings to recover during this cycle was much shorter compared to previous recessions. Notwithstanding the truncated and “hotter” economic cycles, near-term recessionary prospects remain low.

Recently, a number of economic indicators have experienced minor deterioration - consumer sentiment (University of Michigan Consumer Sentiment index is down 12% YoY), wage growth has slowed, additional fiscal programs were put on hold and the Fed creeps towards tighter monetary policy. Fortunately, the Omicron outbreak appears less impactful on the economy than its predecessors - the Atlanta Fed’s GDPNOW tracked a 7.4% real GDP for the fourth quarter; much higher than at any point during the third quarter’s Delta-related disruption. Any decline to the GDPNOW estimate caused by Omicron won’t break the economy. Omicron is proving to be more contagious and less deadly than previous variants; important to note as we transition from pandemic to endemic and face subsequent variants.

As noted, inflation will likely worsen over the next few months but improve during mid to late 2022. For example, the January 20th Baltic Dry Index (a key shipping statistic) is down 20% YoY. The silver lining is that anomalous conditions should revert as supply chain issues ease with enhanced capacity and declining inflation. Much of the excess inflation originated with shifting consumer preferences during the pandemic (services to goods); this was compounded by supply chain constraints (e.g. who would have guessed that used cars are now an appreciating asset class).

As consumer preferences normalize during the transition to endemic, and as supply chain pressures abate, so too should inflation. Core CPI was 4.9% over the last 12 months; 3.1% above the average 1.8% pace over the prior decade (2010–2019). Four categories of goods comprising 14% of the overall CPI basket accounted for almost two-thirds of this increase: new cars, used cars/trucks, apparel and household furnishings. Rising rates alone will not “kill” the Equity markets.

Talking heads explaining the recent reversal in the equity markets point to the Fed’s tightening/raising the Fed funds rate. Current consensus is for 3-4 rate hikes during 2022 to adjust domestic rates from accommodative to more “neutral”. Summarized below are 4 similar adjustments cycles dating back to 1994; in each the equity markets were higher 12 months later. The average return within 18 months of the rate adjustments exceeded 10%.

As long-term investors we neither predict nor anticipate such gains but question the impact of such action on our long-term expectations. Rising rates have a silver lining for conservative investors; they generally equate to greater “safe” income.

Fiscal stimulus?

The ongoing saga of the Build Back Better (BBB) bill highlights the difficulty our lawmakers have transitioning fiscal policy - compare the “no bill” with the relative ease with which the $1.9 trillion American Rescue Plan passed during March 2021. Despite multiple reductions and a crumbling infrastructure (that many acknowledge) desperately in need of patching, upgrading etc., BBB seems to represent a diminishing appetite for more fiscal support during a strong growth environment with above-target inflation. Despite myriad differences between infrastructure rebuilding and well run companies outpacing recovery/growth projections, many investors worry about the “fiscal cliff.” We believe these fears appear overblown. Most of the fiscal response during 2021 targeted income replacement; now much less necessary given the subsequent labor market recovery. Further, there is a very strong relationship between what workers earn and their spending. With aggregate payrolls well above their long-term average and easily outpacing inflation, workers have the means to continue spending. This suggests that consumption, the backbone of the American economy, will continue despite waning fiscal support.

We believe that fears of COVID-19 related deficit, resulting in GDP drag are overblown. Many households saved a portion of their transfer payments, as evidenced by the jump in savings rates during 2020. Although savings rates have normalized, there remains over $2 trillion stockpiled in accumulated savings, fuel for future spending. Finally, another path forward for BBB (albeit a longer-shot) recently emerged. In total, the 2022 fiscal cliff may be more worry then reality.

Given the changes previously noted, gains in the equity markets during 2022 will likely be paired with larger pullbacks; similar to those experienced in 1994 and 2011. The headwind for equities appears more likely to be multiples; given the consensus expectation for a healthy 8.5% earnings growth and recent positive revisions to estimates. Modest multiple compression is typical during this part of a new economic expansion, a dynamic we highlighted one year ago. P/Es did compress in 2021, and we believe further compression may occur in 2022 for similar reasons.

- MSCI World index.

- NASDAQ Composite index

- Bloomberg

The good news is that earnings growth appears robust enough that the outlook for stocks on a full-year basis is solid, even though bouts of volatility may emerge. The noticeable sell-off in the first weeks of 2022 may already be enough to adjust valuations and remind investors that risk premium exists. Another way to articulate it this message is that risk and returns are related.

Despite 2022’s relatively weak start, conditions appear to support longer term strength for the equity markets. Despite the Fed’s “new” old hawkishness, financial conditions remain relatively accommodative compared to historical norms. The U.S. economy has proven surprisingly resilient. As subsequent variants become less disruptive (fingers and toes crossed) – a healthy consumer, strong labor market and robust earnings portend well for equity markets.

As previously noted, the backdrop for corporate profits appears healthy enough to more than offset modest multiple compression and should drive another year of positive equity returns. Although financial markets may be choppier than historical norms, we expect long term investors to be rewarded appropriately for the risk they continue to take.

Please do not hesitate to contact us at any time with questions or to schedule a financial review.

With a deep sense of responsibility,

Michael R Sanders, Principal

Chief Investment Officer

Craig Marson, Principal

Director of Financial Planning

Disclosure: Information contained in this communication is not considered an official record of your account and does not supersede normal trade confirmations or statements. Any information provided has been prepared from sources believed to be reliable but is not, does not represent all available data necessary for making investment decisions and is for informational purposes only. Any distribution, use or copying of this presentation or the information it contains by other than an intended recipient is prohibited. This information is subject to review by supervisory personnel, is retained and may be produced to regulatory authorities or others with a legal right to the information.

This presentation does not constitute an offering or sale of securities. This presentation is not, and under no circumstances is to be construed as, a prospectus, advertisement or public offering of securities. Past performance is not necessarily an indication of future results.

Please remember to contact 5C Capital Management, LLC if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Federal and State securities laws require that we maintain and make available current copies of our Registered Investment Adviser Disclosure Document, also known as Form ADV Part II. Pursuant to SEC Regulation S-P, our Privacy Notice can be found by contacting our office or visiting us at www.5cwealth.com