The Fed Funds target rate is now between 4.25% – 4.5% after last year’s aggressive rate hikes. We expect the fed to raise again on February 1, hopefully very modestly and with strong guidance on a terminal rate. If inflation continues to ebb and unemployment rises, we expect a recession to follow. However, while there is much disagreement on when and how deep the contraction will be, the prevailing opinion is that it will be short-lived.

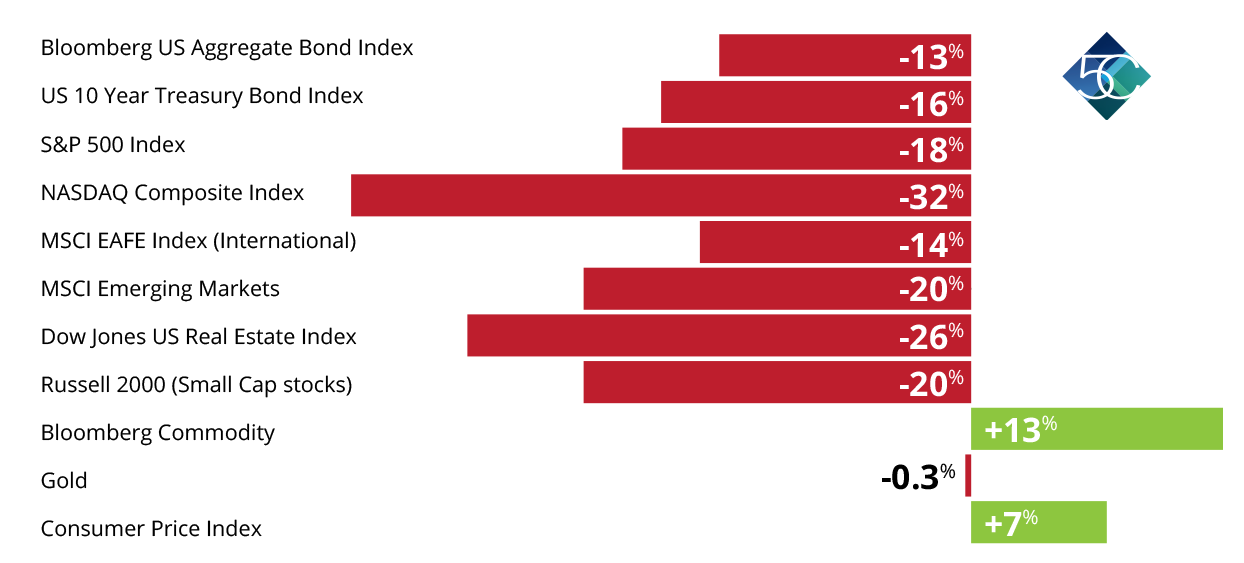

2022 Performance of Broad asset classes:

Again, we hope to experience a relatively short recession followed by an improving macro environment marked by moderating inflation and a yield curve trending towards more normalized ranges.

The better news – employment is relatively strong, corporate and consumer balance sheets are generally well capitalized and – the markets have already incorporated certain recessionary pressures. We hope for a peaceful resolution to the Ukraine/Russia conflict and accompanying positive developments for global markets.

Investment strategy & positioning

A silver lining – short to mid-term fixed income is generating significant income, with yields frequently exceeding 4% on short term US Treasuries, CD’s and high-quality Government Sponsored Entities. In certain situations, municipal bonds provide comparable tax adjusted yields to US Treasuries. We expect short/mid-term fixed income securities that are held to maturity to outperform as they recoup principal value temporarily lost when interest rates rose. Commodities/gold and clean energy outperformed broader equities and provided a modest hedge against inflation.

Key takeaways:

- Continue to stay diversified;

- Consider modestly increasing liquidity to counter additional volatility; and

- Be opportunistic, not fatalistic in response to pockets of market weakness. For example, dividend/value-oriented equity, including broad small cap exposure and targeted growth areas such as clean energy/cyber related technology.

Although financial markets continue to be volatile and negative sentiment persists, we expect long-term investors to be rewarded appropriately for the risk they continue to take.

Please do not hesitate to contact us at any time with questions and to schedule a financial review.

With a deep sense of responsibility,

5C Capital Management’s Investment Team

Michael R Sanders, Principal

Chief Investment Officer

Craig Marson, Principal

Director of Financial Planning

Disclosure: Information contained in this communication is not considered an official record of your account and does not supersede normal trade confirmations or statements. Any information provided has been prepared from sources believed to be reliable but is not, does not represent all available data necessary for making investment decisions and is for informational purposes only. Any distribution, use or copying of this presentation or the information it contains by other than an intended recipient is prohibited. This information is subject to review by supervisory personnel, is retained and may be produced to regulatory authorities or others with a legal right to the information.

This presentation does not constitute an offering or sale of securities. This presentation is not, and under no circumstances is to be construed as, a prospectus, advertisement or public offering of securities. Past performance is not necessarily an indication of future results.

Please remember to contact 5C Capital Management, LLC if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or to modify any reasonable restrictions to our investment advisory services.

Federal and State securities laws require that we maintain and make available current copies of our Registered Investment Adviser Disclosure Document, also known as Form ADV Part II. Pursuant to SEC Regulation S-P, our Privacy Notice can be found by contacting our office or visiting us at

www.5cwealth.com

*Source: Bloomberg. Total returns for period ending 12/31/2022 MSCI World index, NASDAQ Composite index, Russell Indices, Standard & Poors. All returns are rounded to nearest 1% for presentation purposes, with exception of Gold given slight negative return.