Cost Data for 2020-2021 School Year.

Each year, the College Board releases its annual Trends in College Pricing report that highlights current college costs and trends. While costs can vary significantly depending on the region and college, the College Board publishes average cost figures, which are based on a survey of nearly 4,000 colleges across the country.

Public college costs (in-state students)

- Tuition and fees increased 1.1% to $10,560

- Room and board increased 0.96% to $11,620

- Total cost of attendance: $26,820

Public college costs (out-of-state students)

- Tuition and fees increased 0.93% to $27,020

- Room and board increased 0.96% to $11,620

(same as in-state) - Total cost of attendance: $43,280

Private college costs

- Tuition and fees increased 2.1% to $37,650

- Room and board increased 1.0% to $13,120

- Total cost of attendance: $54,880

Note that “total cost of attendance” figures include direct billed costs for tuition, fees, room, and board, plus a sum for indirect costs that includes books, transportation, and personal expenses, which will vary by student.

The result is a figure known as your expected family contribution, or EFC. Your EFC remains constant, no matter which college your child attends. Your EFC is not the same as your child’s financial need. To calculate financial need, subtract your EFC from the cost at a specific college. Because costs vary at each college, your child’s financial need will vary depending on the cost of a particular college.

One thing to keep in mind: Just because your child has financial need doesn’t automatically mean that colleges will meet 100% of that need. In fact, it’s not uncommon for colleges to meet only a portion of it. In this case, you’ll have to make up the gap, in addition to paying your EFC.

To get an estimate ahead of time of what your out-of-pocket costs might be at various colleges, run the net price calculator on each college’s website. A net price calculator asks for income, asset, and general family information and provides an estimate of grant aid at that particular college. The cost of the school minus this grant aid equals your estimated net price, hence the name “net price calculator.”

Reduced asset protection allowance

Behind the scenes, a stealth change in the FAFSA has been quietly and negatively impacting families. The asset protection allowance, which lets parents shield a certain amount of their assets from consideration (in addition to the assets listed above that are already shielded), has been steadily declining for years, resulting in higher EFCs. Fifteen years ago, the asset protection allowance for a 48-year-old married parent with a child about to enter college was $40,500. For 2020-2021, that same allowance is $6,600, resulting in a $1,911.96 decrease in a student’s aid eligibility ($40,500 – $6,600 x 5.64%).3

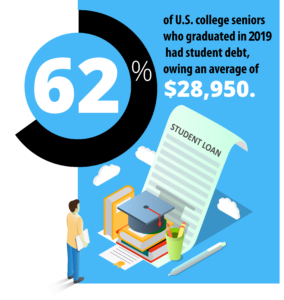

Higher student debt

Student loan debt continues to grow and students debt is now the second-highest consumer debt category ahead of both credit cards and auto loans and behind only only mortgage debt. About 62% of U.S. college seniors who graduated in 2019 had student debt4. owning an average of $28,9505. And it’s not just students who are borrowing. Parents are borrowing too. There are approximately 15 million student loan borrowers age 40 and older, and this demographic accounts for almost 40% of all student loan debt.6

Education planning is a critical goal that many parents and grandparents worry about. At 5C we educate our clients on implementing a liability match framework, which includes starting early and having a coordinated investment strategy. Please do not hesitate to contact us at 5C to review your current plans, create a new ones and plan for the future.

Sources/References:

1) College Board, 2020

2-3) U.S. Department of Education, The EFC Formula, 2021-2022, 2005-2006

4) Federal Reserve Bank of New York, Quarterly Report on Household Debt and Credit, August 2018

5) Institute for College Access & Success, Student Debt and the Class of 2019, October 2020

6) Federal Reserve Bank of New York, Student Loan Data and Demographics, September 2018

5C Capital Management help you untangle the process, provide you with actionable next steps.